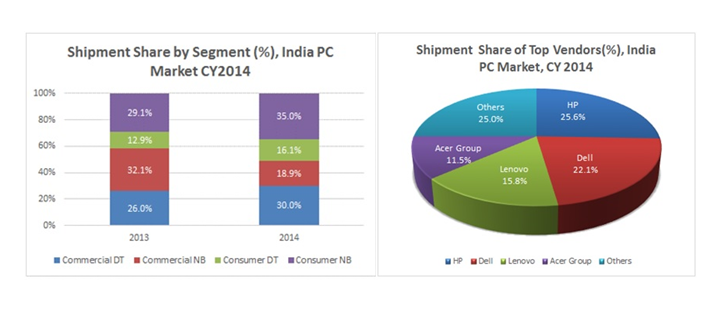

CY 2014 proved to be an interesting phase for the India PC business. The results for the consumer business turned out to be unexpected both in the beginning and towards the end of the year i.e. Q1 and Q4 2014. While Q1 recorded a new low, Q4 results turned out to be very positive beating our forecasts substantially. The overall India PC shipments for CY 2014 stood at 9.6 million units, down 16.5% year-on-year from CY 2013. Outside special deals, the overall market witnessed a marginal year-on-year drop of 0.4% in CY 2014.

The overall market declined initially in the run-up to the 16th general elections held in H1 2014. However, PC sales recovered starting June owing to innovative pricing actions by vendors mixed with festive buying and pent-up demand boosting the overall sales.

The consumer PC market stood at 4.9 million units in CY 2014, with a year-on-year growth of 1.7% over CY 2013. “Continuing from CY 2013, consumer sentiments remained frail until elections. However, stable government in the centre aided hopes on reforms and economic progress boosting overall end-user confidence. Also, subsiding inflation and rapid growth of online trade coupled with the introduction of sub $400 devices created just the right buzz for PC business in CY 2014.” Comments Kiran Kumar, Research Manager, IDC.

The overall commercial PC market clocked 4.7 million units in CY 2014, with a year-on-year drop of 29.6% over CY 2013. “The primary reason for the plunge was that barring fulfilments for ELCOT Phase III, the contribution of large education projects was not exciting in CY2014 as compared to CY2013. Also, enterprise users have been cautiously optimistic by pinning their hopes on the direction of reforms which is still quite ambiguous.

This is with the exception of BFSI, where IT spending returned to a rapid surge in CY 2014 for both capacity expansion and hardware refresh,” comments Manish Yadav, Market Analyst, IDC.