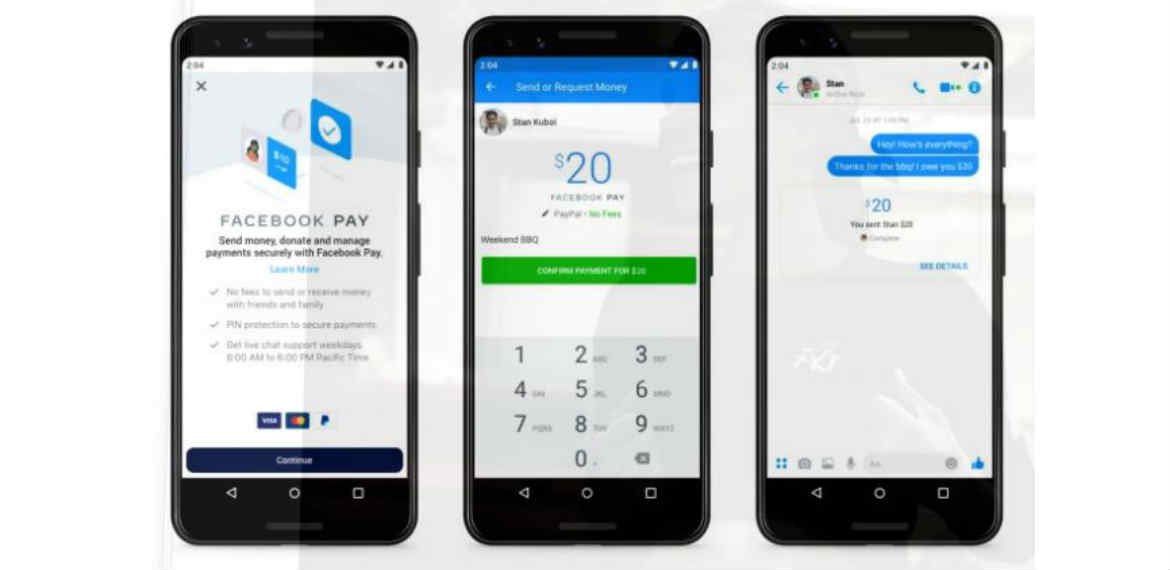

Nowadays, most tech companies are launching their own micro-transaction services. Not to be left behind, Facebook has launched Facebook Pay, its own micro-transaction service that allow users to send and receive money on its apps and services.

Facebook Pay is a unified payment service by the company which will be used to send and receive money on Facebook, Messenger, Instagram, and WhatsApp. Since most people do financial transactions online nowadays, this is a helpful feature to those who regularly use the company’s apps and services.

With Facebook Pay, users can use their credit or debit card to make payments and purchases. It also supports PayPal. It will automatically remember the user’s payment method, and users have the flexibility to set it up app-by-app. Of course, they can also view their payment history, manage payment methods and update the settings of Facebook Pay.

Under the hood, payments done with Facebook Pay are processed in partnership with PayPal and Stripe. The company ensures that all bank account numbers are encrypted and stored securely for the user’s peace of mind. There’s also an anti-fraud monitoring system, and Facebook Pay can be set up to use biometric authentication. The company promises that it won’t store sensitive information, but given the track record of the company with privacy and security, a little doubt comes to mind.

To start using Facebook Pay, users must go to “Settings” > “Facebook Pay” on the Facebook app or website. When setting it up, users will be prompted for their preferred payment method. As of right now, it is only available in US, and it will roll out to more countries in the coming months.

Facebook has been aggressive in breaking out to new market segments, especially in digital currency and payment service. Earlier this year, it launched Libra, its own cryptocurrency that was criticized in light of the scandal the company faced in recent years.

(Photo source: https://about.fb.com)