Managing money. It’s not something we discuss out in the open, but personal finance is an important issue for all of us. Every time we receive our credit card bill or get a paycheck, we make a mental promise to ourselves to spend less money, be more disciplined, and try to save more. But like most habits, it’s difficult to follow through, and most of us find ourselves in the same place the next month.

Filipino millennials are overall distrustful of financial institutions. They know that money management is important; over 68% of them (aged 15-29) agree that they are “strongly interested in future financial planning.” However, they feel excluded from financial institutions; only 15% of Filipino millennials saved at a financial institution in the past year.

This doesn’t mean that you can’t make a change this New Year. Whether you want to save for a getaway during a long weekend, budget for your gift shopping during the holidays, or set financial and savings goals for the coming year, there’s always hope. Below are few tips our users have found useful.

Know Yourself

Sit down and take a look at where you stand. Gather up all your income information including salaries, bonuses, investments, debts and major expenses. A healthy budget consists of 30% on housing and 25-30% on living expenses (car payments, bills, groceries). Take advantage of bonuses and tax breaks and use the extra earnings to pad up your retirement fund.

Keep Track

Have you ever wondered, “Where did all my money go?” Unfortunately, with personal finances ignorance is not bliss. Before getting in control of your money, you need to understand exactly what your expenses are. Check your statements for extra charges that can add up — like your afternoon macchiato, monthly subscription fees, or health club memberships. The small 100 or 500 peso monthly charges can add up to thousands over a year.

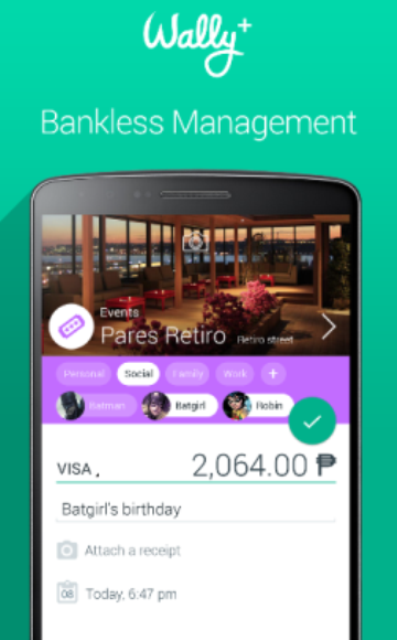

The easiest way to do this is to use an expense tracker app, like Wally, and keep track of your spending. Studies show that just tracking money makes you spend significantly less.[1]

With Wally, users can track expenses as they make them, tagging them with their location, category (for example, “dining out”), and who they’re spending money with. You can even add photos of the venue when you enter an expense, and indicate why you’re spending money (whether it’s for family, work, social, or personal reasons).

Pick a Salient Date

Whether it is payday or the first of the month, pick one day of the month to sit back and review the previous month’s financial situation. Look through your bank statements (or your Wally) in detail and take note of patterns.

With increase in downloads by 60% on the first few days each month, it shows that users know they should be doing something to get in control. With Wally you can adjust the start of your financial month to coincide with payday to keep everything aligned.

Switch to Cash

While credit cards are extremely convenient, it’s easy to forget about transactions that are done with just a swipe. Studies show that we’re willing to pay more for items when we’re using credit cards, as opposed to cash.[2] Withdraw the cash you think you’ll need for a week, and leave your cards at home. This by itself will help you control your spending.

Make Good Use of Extra Cash

With end-of-year bonuses, resist the urge to spend all the money right away. Use a third to pay off an old debt, a third for a future emergency fund and then use the remaining third to treat yourself. Remember, your retirement fund should have 20 times the annual income you need to survive. Get a head start on it.

Make Changes for the Future

Once you’ve taken control of your finances, set goals to improve your situation. Keep yourself informed and understand if you’re spending more unnecessarily. Wally shows you anonymous comparisons to groups of users similar to you, to help you answer questions like “Are my spending patterns typical? Do I save more or less than people like me?”

Managing finances may be challenging to some, but it doesn’t mean that it isn’t doable. And the right time to start is now.